California Tax Preparer Course

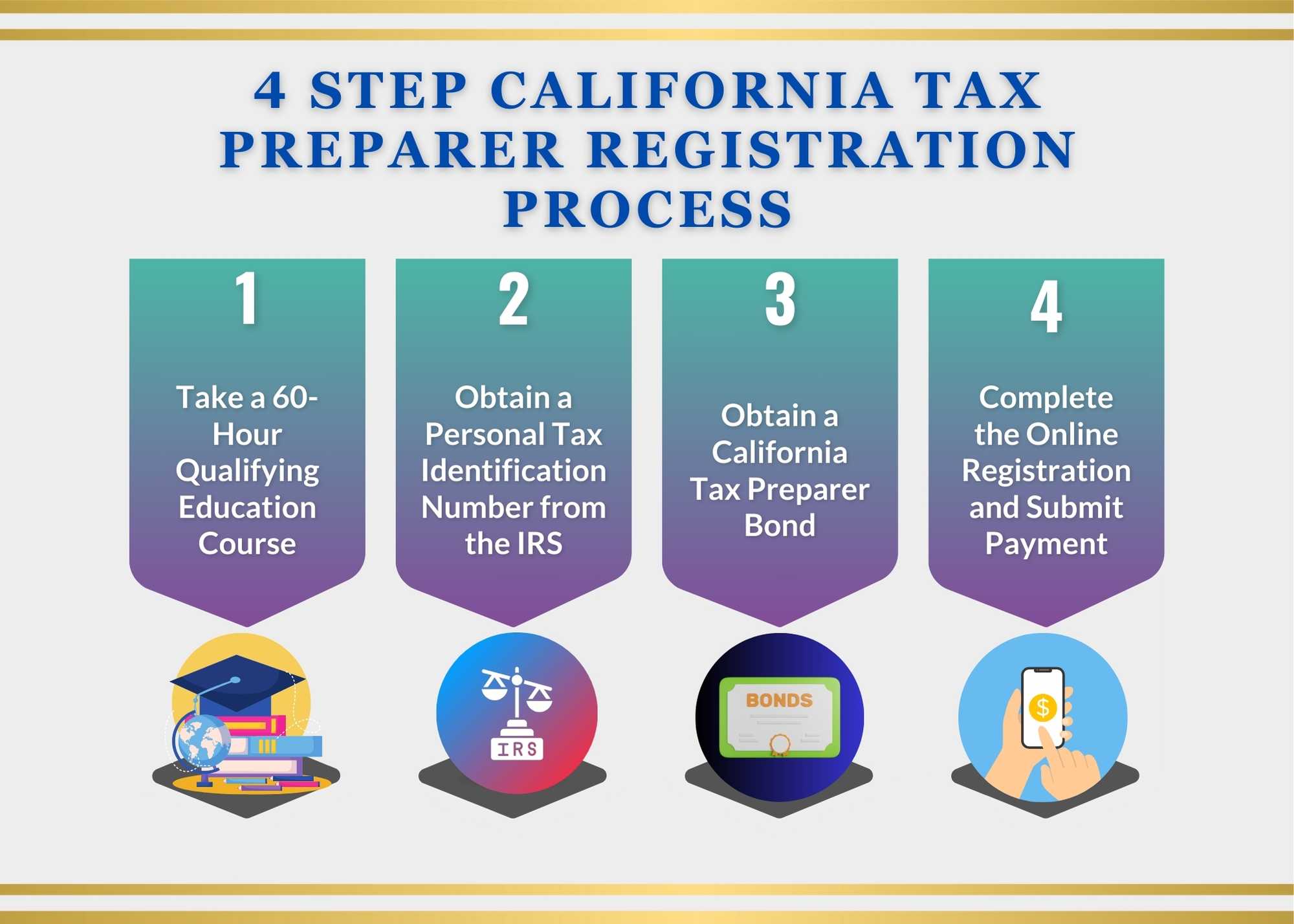

California Tax Preparer Course - These exams are open book and can. If you want to learn everything there is to know about tax preparation and become a crtp (ctec registered tax preparer), this course will fulfill your knowledge and ctec requirements. This 60 credit hour course for new tax preparers includes 3 comprehensive exams covering california state tax law, federal tax law, and ethics. Cpe credits for easwebinars & seminarscpe credits for cpasunlimited cpe credits Work seasonally and earn a high income with our approved ctec 60 hour and 20 hour qualifying tax preparer courses. New 2025 edition coming soon. Golden state tax training institute has built a course using our 30 years of. After that, apply online at. Ctec approved 60 hour qualifying education course for individuals interested in becoming a california registered tax preparer (crtp) or who have failed to maintain their annual. It covers everything you need to know to file both federal and california. Each semester we offer several sections of. Work seasonally and earn a high income with our approved ctec 60 hour and 20 hour qualifying tax preparer courses. If you want to learn everything there is to know about tax preparation and become a crtp (ctec registered tax preparer), this course will fulfill your knowledge and ctec requirements. Complete a “basic income tax” course (preferably at pronto tax school) that includes at least 45 hours of federal income tax instruction and at least 15 hours of california state income tax. To prepare taxes for compensation in california, you must complete a 60 hour qualifying education course. Discover the role and responsibilities of a tax preparer. Learn how to become a tax preparer in california through ctec registration, education, and training. These exams are open book and can. It includes both california and federal taxation. We offer you the best in tax education. This ctec 60 hour course is for individuals interested in becoming a certified tax preparer in the state of california. Golden state tax training institute has built a course using our 30 years of. It covers everything you need to know to file both federal and california. Ctec approved 60 hour qualifying education course for individuals interested in becoming a. This ctec 60 hour course is for individuals interested in becoming a certified tax preparer in the state of california. California residents must provide an active ptin, maintain a $5,000 tax preparer insurance bond, and complete 20 hours of ce by october 31st each year to renew their registration with the. To prepare taxes for compensation in california, you must. It covers everything you need to know to file both federal and california. If you want to learn everything there is to know about tax preparation and become a crtp (ctec registered tax preparer), this course will fulfill your knowledge and ctec requirements. We offer you the best in tax education. Ctec approved 60 hour qualifying education course for individuals. To prepare taxes for compensation in california, you must complete a 60 hour qualifying education course. This ctec 60 hour course is for individuals interested in becoming a certified tax preparer in the state of california. We offer you the best in tax education. New 2025 edition coming soon. It covers everything you need to know to file both federal. This 60 credit hour course for new tax preparers includes 3 comprehensive exams covering california state tax law, federal tax law, and ethics. To prepare taxes for compensation in california, you must complete a 60 hour qualifying education course. Ctec approved 60 hour qualifying education course for individuals interested in becoming a california registered tax preparer (crtp) or who have. These exams are open book and can. Discover the role and responsibilities of a tax preparer. Santa ana college is a qualified tax education provider, approved by the california tax education council (ctec). Complete a “basic income tax” course (preferably at pronto tax school) that includes at least 45 hours of federal income tax instruction and at least 15 hours. This ctec 60 hour course is for individuals interested in becoming a certified tax preparer in the state of california. It includes both california and federal taxation. It covers everything you need to know to file both federal and california. After that, apply online at. Golden state tax training institute has built a course using our 30 years of. Work seasonally and earn a high income with our approved ctec 60 hour and 20 hour qualifying tax preparer courses. Ctec approved 60 hour qualifying education course for individuals interested in becoming a california registered tax preparer (crtp) or who have failed to maintain their annual. Complete a “basic income tax” course (preferably at pronto tax school) that includes at. California residents must provide an active ptin, maintain a $5,000 tax preparer insurance bond, and complete 20 hours of ce by october 31st each year to renew their registration with the. To prepare taxes for compensation in california, you must complete a 60 hour qualifying education course. If you want to learn everything there is to know about tax preparation. Ctec approved 60 hour qualifying education course for individuals interested in becoming a california registered tax preparer (crtp) or who have failed to maintain their annual. Cpe credits for easwebinars & seminarscpe credits for cpasunlimited cpe credits To prepare taxes for compensation in california, you must complete a 60 hour qualifying education course. Complete a “basic income tax” course (preferably. Work seasonally and earn a high income with our approved ctec 60 hour and 20 hour qualifying tax preparer courses. These exams are open book and can. Complete a “basic income tax” course (preferably at pronto tax school) that includes at least 45 hours of federal income tax instruction and at least 15 hours of california state income tax. We offer you the best in tax education. Santa ana college is a qualified tax education provider, approved by the california tax education council (ctec). New 2025 edition coming soon. Cpe credits for easwebinars & seminarscpe credits for cpasunlimited cpe credits Golden state tax training institute has built a course using our 30 years of. This ctec 60 hour course is for individuals interested in becoming a certified tax preparer in the state of california. To prepare taxes for compensation in california, you must complete a 60 hour qualifying education course. California residents must provide an active ptin, maintain a $5,000 tax preparer insurance bond, and complete 20 hours of ce by october 31st each year to renew their registration with the. After that, apply online at. Learn how to become a tax preparer in california through ctec registration, education, and training. Discover the role and responsibilities of a tax preparer. Ctec approved 60 hour qualifying education course for individuals interested in becoming a california registered tax preparer (crtp) or who have failed to maintain their annual. This 60 credit hour course for new tax preparers includes 3 comprehensive exams covering california state tax law, federal tax law, and ethics.California Tax Preparer Training

A Certified Tax Preparer Your Step By Step Guide

California Tax Preparer 5,000 Bond

Online Chartered Tax Professional for California Residents from San

Official Tax Preparer Coffee Mug 11oz California Tax Courses

California Tax Preparer License Guide Surety Bond Insider

California Tax Preparer Bond Surety Bonds by Axcess

The Tax School on LinkedIn Registered as a tax preparer with

California Tax Courses CTEC & IRS Education Provider

CTEC Qualifying CTEC Continuing Education CA Tax Preparer CTEC

It Includes Both California And Federal Taxation.

If You Want To Learn Everything There Is To Know About Tax Preparation And Become A Crtp (Ctec Registered Tax Preparer), This Course Will Fulfill Your Knowledge And Ctec Requirements.

Each Semester We Offer Several Sections Of.

It Covers Everything You Need To Know To File Both Federal And California.

Related Post: