Example Of Holder In Due Course

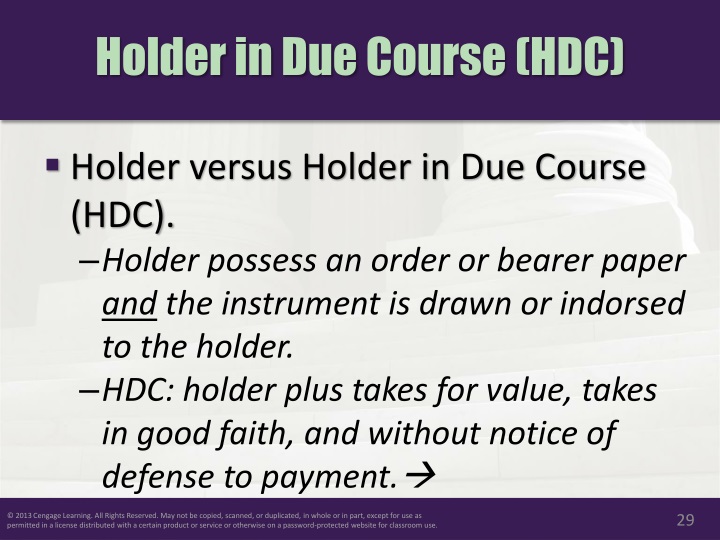

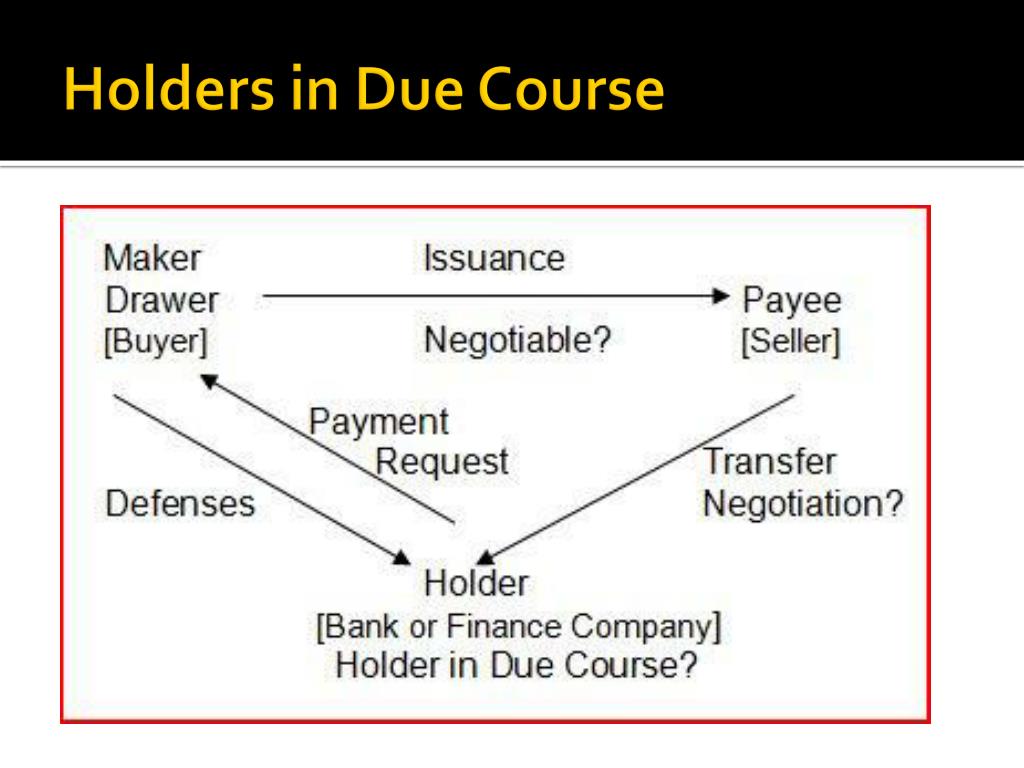

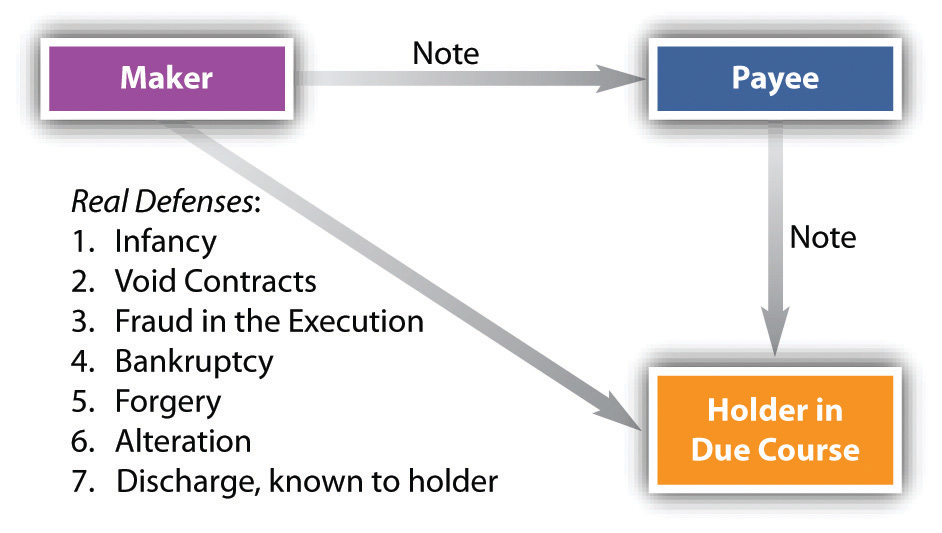

Example Of Holder In Due Course - The rights of a holder in due course of a negotiable instrument are qualitatively, as matters of law, superior to those provided by ordinary species of contracts: Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. This includes having it transferred to them, paying for it, and receiving it without knowing about. The holder is referred to as the assignee. Holder is a person who is entitled for the possession of a negotiable instrument in his own name. Bobby signs a promissory note to repay the $100,000. The rule often referred to as the holder in due course rule is actually titled preservation of consumer claims and defenses. it is a rule issued by the federal trade commission and applies to entities that sell and finance consumer goods. This means that the holder. A holder in due course is someone who has obtained a negotiable instrument in a proper way. A holder in due course is someone who has taken good faith possession of a negotiable instrument. It refers to a person who has received a specific type of document, known as a 'negotiable instrument', in good faith. The holder in due course is often considered innocent of any claims. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; A holder in due course is someone who has obtained a negotiable instrument in a proper way. A holder in due course is a person who receives or holds a negotiable instrument, such as a check or promissory note, in good faith and in exchange for value. What is an example of a holder in due course? Bobby signs a promissory note to repay the $100,000. The holder is referred to as the assignee. A 'holder in due course' is a term used in the world of finance and law. What the holder in due course gets is an instrument free of claims or defenses by previous possessors. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; According to section 9 of the negotiable instruments act, a holder in due course is someone who has obtained the instrument for value, in good faith, and without any notice. What the holder in due course gets is an instrument free of claims or defenses by previous possessors. A holder in due course is someone who has taken good faith possession of a negotiable instrument. The holder is in a very important role as they are. It refers to a person who has received a specific type of document, known. Hence he shall receive or recover the amount due thereon. A holder in due course is a person who receives or holds a negotiable instrument, such as a check or promissory note, in good faith and in exchange for value. Bobby signs a promissory note to repay the $100,000. A holder in due course is someone who has taken good. The holder is referred to as the assignee. This means that the holder. Bank of america loan bobby $100,000 for a mortgage on a home; The holder in due course is often considered innocent of any claims. A holder in due course is a person who receives or holds a negotiable instrument, such as a check or promissory note, in. Negotiated to the holder does not bear such apparent evidence of. What is an example of a holder in due course? The holder in due course is often considered innocent of any claims. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects. A holder with such a preferred position can then treat the instrument. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. They are in possession of the assignor's rights and liabilities. A holder in due course is someone who has. A holder in due course is one possessing a check or promissory note, given in return for something of value, who has no knowledge of any defects or contradictory claims to its. What is an example of a holder in due course? Bank of america loan bobby $100,000 for a mortgage on a home; What the holder in due course. Hence he shall receive or recover the amount due thereon. What the holder in due course gets is an instrument free of claims or defenses by previous possessors. This includes having it transferred to them, paying for it, and receiving it without knowing about. It refers to a person who has received a specific type of document, known as a. This means that the holder. Bobby signs a promissory note to repay the $100,000. According to section 9 of the negotiable instruments act, a holder in due course is someone who has obtained the instrument for value, in good faith, and without any notice of. The holder is referred to as the assignee. What is an example of a holder. A holder in due course is one possessing a check or promissory note, given in return for something of value, who has no knowledge of any defects or contradictory claims to its. Holder is a person who is entitled for the possession of a negotiable instrument in his own name. The holder is referred to as the assignee. Bobby signs. A 'holder in due course' is a term used in the world of finance and law. Bank of america loan bobby $100,000 for a mortgage on a home; According to section 9 of the negotiable instruments act, a holder in due course is someone who has obtained the instrument for value, in good faith, and without any notice of. They are in possession of the assignor's rights and liabilities. A holder in due course refers to someone who receives a negotiable instrument, such as a check, promissory note, or bank draft, under specific conditions. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. The holder in due course is often considered innocent of any claims. Hence he shall receive or recover the amount due thereon. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; Negotiated to the holder does not bear such apparent evidence of. The rule often referred to as the holder in due course rule is actually titled preservation of consumer claims and defenses. it is a rule issued by the federal trade commission and applies to entities that sell and finance consumer goods. It refers to a person who has received a specific type of document, known as a 'negotiable instrument', in good faith. A holder in due course is someone who has obtained a negotiable instrument in a proper way. The holder is in a very important role as they are. A holder with such a preferred position can then treat the instrument. What the holder in due course gets is an instrument free of claims or defenses by previous possessors.PPT Chapter 16 Negotiability, Transferability, and Liability

PPT Holders in Due Course PowerPoint Presentation, free download ID

PPT Chapter 16 Negotiability, Transferability, and Liability

Chapter 32 Negotiation and Holder in Due Course

Holder & holder in due course PPT

Holder in Due Course and Defenses

TRANSFERABILITY AND HOLDER IN DUE COURSE ppt download

Holder in Due Course

TRANSFERABILITY AND HOLDER IN DUE COURSE ppt download

Holder & Holder In Due Course

A Holder In Due Course Is A Person Who Receives Or Holds A Negotiable Instrument, Such As A Check Or Promissory Note, In Good Faith And In Exchange For Value.

This Includes Having It Transferred To Them, Paying For It, And Receiving It Without Knowing About.

Bobby Signs A Promissory Note To Repay The $100,000.

The Holder Is Referred To As The Assignee.

Related Post:

.jpg)