Holder In Due Course Doctrine

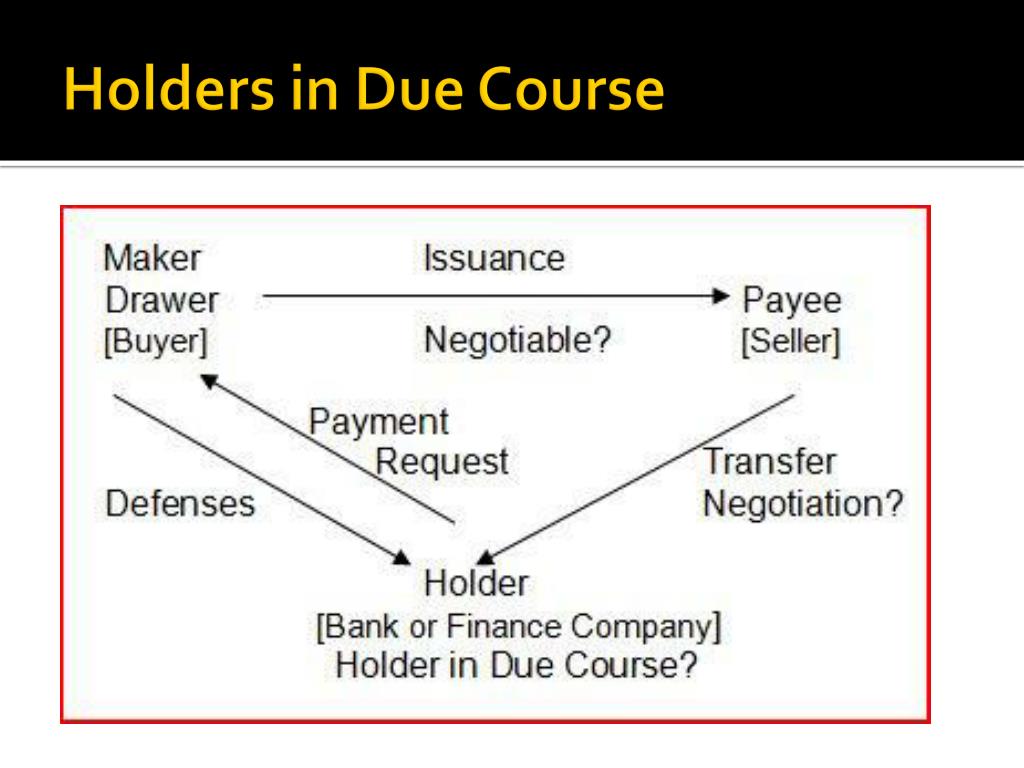

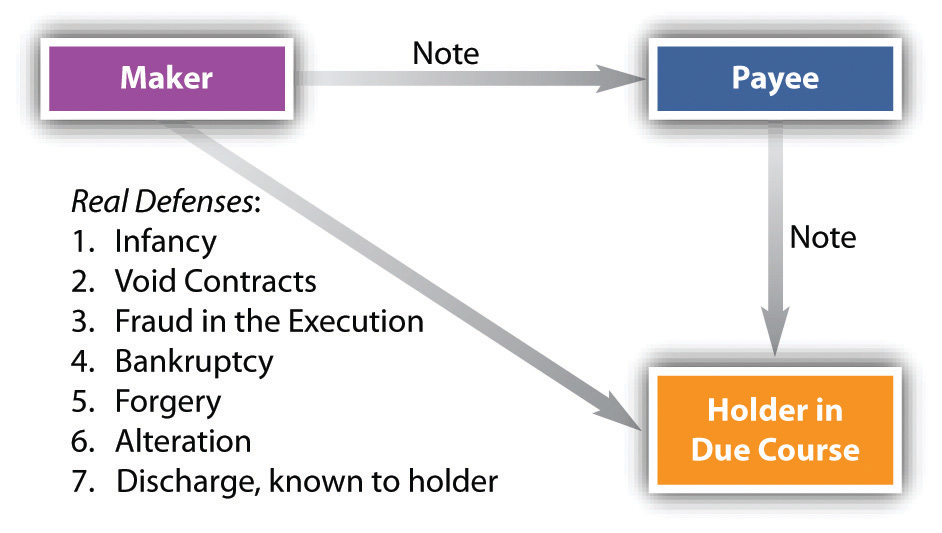

Holder In Due Course Doctrine - It explains that under this doctrine, a holder in due course takes a negotiable instrument like a check or promissory note free from certain claims and defenses. Under this doctrine, the obligation to pay. Know what the requirements are for being a holder in due course. According to section 9 of the negotiable instruments act, a holder in due course is someone who has obtained the instrument for value, in good faith, and without any notice of. Nevertheless, the holder in due course doctrine will not provide a payee with the benefits of a holder in due. A “holder in due course” is someone who gets a special status when they receive a negotiable. Understand why the concept of holder in due course is important in commercial transactions. The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in good faith, for. The holder in due course doctrine as a default rule. What defenses are good against a holder in due course; Nevertheless, the holder in due course doctrine will not provide a payee with the benefits of a holder in due. Understand why the concept of holder in due course is important in commercial transactions. It discusses how the doctrine. Know what the requirements are for being a holder in due course. Payee may become a holder in due course if she satisfies all of the requirements. According to the ucc, a “holder” of a negotiable instrument is “a person who is in possession of an instrument drawn, issued or endorsed to him or to his order or to bearer or in blank.” The rule is particularly problematic in the consumer debt context where a business offers to finance a consumer purchase by accepting a promissory note signed by a consumer for part or all of the balance in lieu of tender of the full cash price, then sells the note to a bank (technically, by selling an assignment of its rights in the note) in order to immediately record a profit. The holder in due course (hdc) doctrine is a rule in commercial law that protects a purchaser of debt, where the purchaser is assigned the right to receive the debt payments. It explains that under this doctrine, a holder in due course takes a negotiable instrument like a check or promissory note free from certain claims and defenses. (1) the instrument when issued or negotiated to the holder does not bear such. What defenses are good against a holder in due course; (1) the instrument when issued or negotiated to the holder does not bear such. What a holder in due course is, and why that status is critical to commercial paper; Introduction the “holde r in due course” doctrine, as implemented by article 3 of the. The holder in due course. Introduction the “holde r in due course” doctrine, as implemented by article 3 of the. Know what the requirements are for being a holder in due course. Understand why the concept of holder in due course is important in commercial transactions. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule. The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in good faith, for. It discusses how the doctrine. The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in. Under this doctrine, the obligation to pay. The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in good faith, for. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation of consumers' claims. The preservation of consumers’ claims and defenses [holder in due course rule], formally known as the trade regulation rule concerning preservation of consumers' claims and. The holder in due course doctrine as a default rule. The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument. Understand why the concept of holder in due course is important in commercial transactions. The holder in due course doctrine as a default rule. What defenses are good against a holder in due course; The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in. Know what the requirements are for being a holder in due course. According to the ucc, a “holder” of a negotiable instrument is “a person who is in possession of an instrument drawn, issued or endorsed to him or to his order or to bearer or in blank.” The negotiable instrument act provides various rights to holder in due course.. The holder in due course doctrine as a default rule. The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in good faith, for. (1) the instrument when issued or negotiated to the holder does not bear such. The rule is particularly problematic in the. According to the ucc, a “holder” of a negotiable instrument is “a person who is in possession of an instrument drawn, issued or endorsed to him or to his order or to bearer or in blank.” The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable. According to the ucc, a “holder” of a negotiable instrument is “a person who is in possession of an instrument drawn, issued or endorsed to him or to his order or to bearer or in blank.” A “holder in due course” is someone who gets a special status when they receive a negotiable. Under ucc article 3, a holder in. The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in good faith, for. The holder in due course rule can sometimes have highly inequitable effects on consumers. It discusses how the doctrine. The holder in due course (hdc) doctrine is designed to protect holders from culpability in situations where they performed no wrongdoing, but might be affected by another. The rule is particularly problematic in the consumer debt context where a business offers to finance a consumer purchase by accepting a promissory note signed by a consumer for part or all of the balance in lieu of tender of the full cash price, then sells the note to a bank (technically, by selling an assignment of its rights in the note) in order to immediately record a profit. Under this doctrine, the obligation to pay. The holder in due course (hdc) doctrine is a rule in commercial law that protects a purchaser of debt, where the purchaser is assigned the right to receive the debt payments. What defenses are good against a holder in due course; The holder in due course doctrine, as implemented by article 3 of the uniform commercial code, says that a party who acquires a negotiable instrument in good faith, for. According to section 9 of the negotiable instruments act, a holder in due course is someone who has obtained the instrument for value, in good faith, and without any notice of. Payee may become a holder in due course if she satisfies all of the requirements. The holder in due course doctrine as a default rule. Understand why the concept of holder in due course is important in commercial transactions. According to the ucc, a “holder” of a negotiable instrument is “a person who is in possession of an instrument drawn, issued or endorsed to him or to his order or to bearer or in blank.” Introduction the “holde r in due course” doctrine, as implemented by article 3 of the. Know what the requirements are for being a holder in due course.PPT CHAPTER 36 HOLDERS IN DUE COURSE AND DEFENSES PowerPoint

PPT Chapter 14 PowerPoint Presentation, free download ID7043922

TRANSFERABILITY AND HOLDER IN DUE COURSE ppt download

PPT Chapter 17 PowerPoint Presentation, free download ID6454067

Holder In Due Course Section 9 at Debi Combs blog

PPT Chapter 16 Negotiability, Transferability, and Liability

TRANSFERABILITY AND HOLDER IN DUE COURSE ppt download

PPT Holders in Due Course PowerPoint Presentation, free download ID

Holder in Due Course and Defenses

Holder in Due Course

The Negotiable Instrument Act Provides Various Rights To Holder In Due Course.

What A Holder In Due Course Is, And Why That Status Is Critical To Commercial Paper;

The Preservation Of Consumers’ Claims And Defenses [Holder In Due Course Rule], Formally Known As The Trade Regulation Rule Concerning Preservation Of Consumers' Claims And.

It Explains That Under This Doctrine, A Holder In Due Course Takes A Negotiable Instrument Like A Check Or Promissory Note Free From Certain Claims And Defenses.

Related Post:

.jpg)